Widen the tax base! Stop kicking the can down the road.

₹12L tax rebate is like giving a Saridon to someone who has migraine.

I would recommend reading the article before going through the flowchart.

It’s been more than two weeks since the budget. The dust has settled. No tax up to ₹12 lakhs (₹12.75 if you’re salaried) is the talk of the town - a good move by the government. Real wage growth has been stagnant for the last 10 years. Middle-class taxpayers were just earning to put food on their tables and pay taxes.

So, points to the government.

But if you look at the bigger picture, this move is part of a bigger problem that the government has been trying to solve for the last 10 years.

What is that problem, you ask?

Consumption.

60% of India’s GDP comes from domestic consumer spending, making it the primary growth engine of the economy. So if the government wants to achieve its 5 trillion $ target, you and I have to consume more and more.

This article is an attempt to look at consumption from two perspectives: corporate tax and income tax.

Let’s go.

To drive consumption…

…the government lowered corporate tax.

In 2019, India lowered its corporate tax rate from 30 to 22% for existing companies and from 25 to 15% for new ones.

Intention was that if you give tax cuts to companies, they will use the additional cash for CAPEX, hire more people, wages will increase, people will spend, and the economy will grow. And because the China+1 hypothesis was also very prevalent at that time, this move made even more sense.

Cost to government? A tax revenue loss of around 1.5 lakh crore in 2020-21.

Outcome?

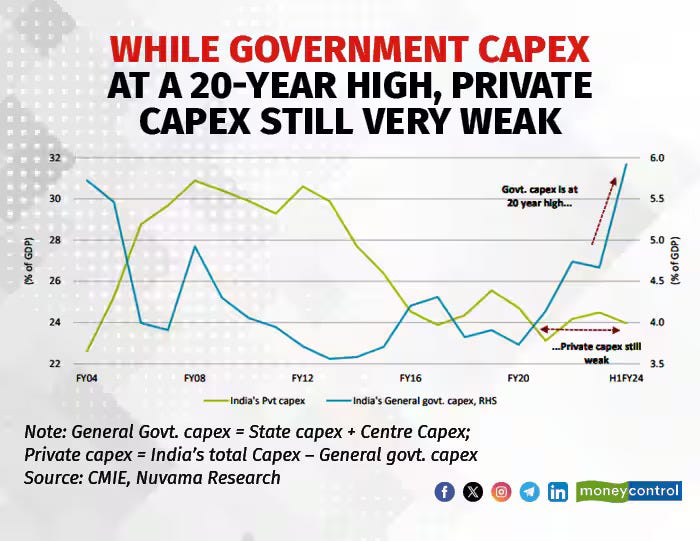

1. Private CAPEX didn’t go up

You might say, “Oh, the COVID hit right after the tax cut. No company in their right mind would do capex in such an uncertain environment.”

Okay. But what about after covid ? Still no jump.

2. Real wages didn’t go up

3. Companies who wanted to do China+1 chose Vietnam over India because of too many non-tariff barriers such as licenses required in India. Link

4. But corporate profits went 4x between 2020 to 2024.

Fat CEOs got fat packages doing absolutely nothing.

India's Corporate Profit to GDP Ratio hits 15 Year High

What does it tell you?

Companies got a tax break but did not invest the money or hire more people or gave salary increments to their employees. They used the funds to increase top management salaries, restructure their debt, and pump stock prices.

Clearly, the government failed to spur consumption through corporate tax cuts.

Then…

…the attention was diverted towards income tax in 2024.

Government was like, “we tried once giving money in the hands of corporates but failed. Let’s now put money in the hands of people and see.”

But the thing with income tax is: there is a huge disparity.

With the context of inequality in mind, let’s brainstorm what possible options the government could have considered to spur consumption before finally settling down to ₹12 lakh tax rebate.

Option 1: Get more people under the tax bracket

If you can tax more people, you get more revenue. With this additional money, you can do public capital expenditure such as building roads, highways etc which is a great way to spur consumption.

Or you can reduce the tax rates for everybody. ₹10 from 10 people equals ₹100. ₹5 from 20 people also equals ₹100.

But this is one hell of a task. Because of two reasons.

a) People have less income - India’s per-capita income is way too low. People simply don’t earn enough that you can tax them. This is evident in India’s low tax-to-GDP number.

b) those who do have a taxable income easily evade taxes

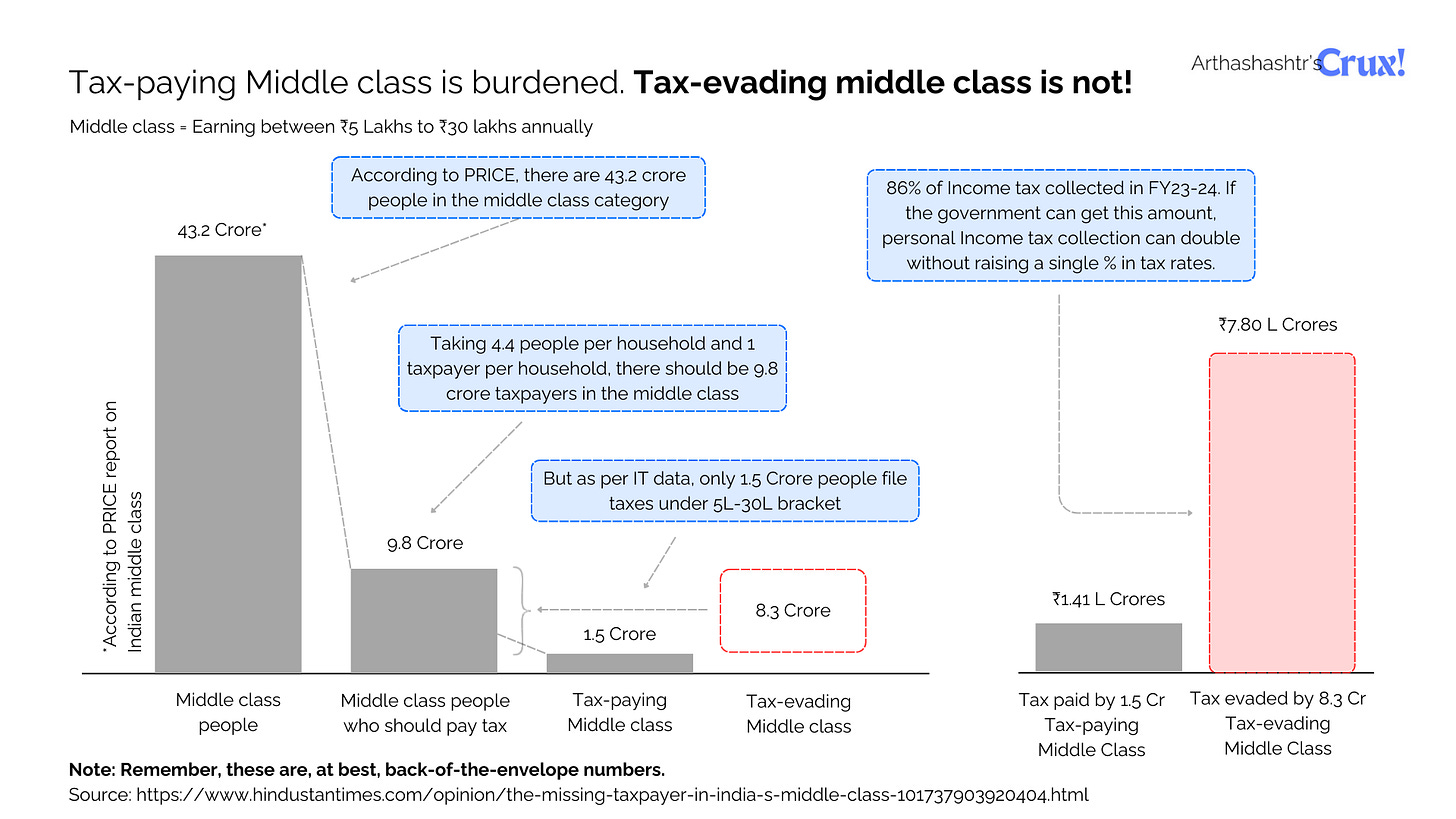

The common sentiment is that the middle class is burdened the most, right?

No. Wrong.

The correct wording should be that the tax-paying middle class is burdened the most, or you can say the salaried middle class.

Let’s do some back-of-the-envelope calculations.

Corporates are no different. It is damnn easy to hide non-salaried income in India.

Here are three ways companies can evade taxes in India. If you are planning to do a startup, take notes.

It will take a ton of effort and a well-crafted policy to get more people under the tax bracket. So what’s the next option?

Option 2. Fix litigation - recover the tax under disputes or simply not paid.

Rs 15.4 lakh crore is stuck in tax disputes and litigation. Half of it is owed by corporations. Source: Revenue Budget 2025-26.

I sometimes think, is it that easy to evade taxes if you run a company? Why isn’t the government going after these fraudsters?

If the government tries hard to recover this money, or even some part of it, it can be a huge addition to the tax revenue.

But again, it’s hard to do.

Option 3. No tax up to 12 lakhs of income

This is what the government has done. It is going to cost 1 to 1.5 lakh crores in tax revenue - roughly the same as the corporate tax cut did in 2019.

However, the corporate tax cut failed to achieve its intended outcome. Government is hoping that this time it will succeed.

How is the government going to finance this 1.5 lakh crore you ask?

Well, in the latest budget, CAPEX growth has been kept flat and the amount spent on subsidies has been reduced. So from there, the government can free up some space. Moreover, if the entire 1.5 lakh crore is financed with more debt, it would mean a 5-8% jump in borrowings.

No matter how it is financed, it’s a big relief to those who fall into that bracket and pay taxes. We all agree I’m sure. But only a handful of people would benefit from it as you would know by now. And thus, the multiplying factor would also be small.

If the government crafts a good policy to bring more people who should technically pay tax under the tax ambit and develops a good mechanism to solve taxes under disputes, it would unlock a separate chest of revenue altogether.

This chest can be used to do public capital expenditure which would have a massive multiplier effect on the economy. And not to mention, this move will be structural and long term, rather than the ₹12 lakh rebate which would even out in a couple of years because of inflation.

But like every year, the government kicked the can of “structural issues with taxation in India” down the road.

This is a policy problem -- this is a morality problem. Everybody wants infrastructure of Singapore in their cities and neighbourhood -- but when it comes to paying taxes, nobody wants to pay. Politicians will need to bring this aspect out. Paying taxes is a national duty. Do your bit should be the message.

The direct personal tax cuts probably have a better retention rate, but still have a low multiplier effect on GDP. Until we can address the root cause of stagnated/reducing private capital formation, we won't be able to spur growth in the medium term. I think the corporate tax cuts misdiagnosed the problem as 'lack of capital' to invest, rather than seeing it as 'business not having an incentive to invest'.